By Laura Mueller, Content Director and Aviation Finance Industry Chair, Airfinance Journal

As featured in Airfinance Journal and shared with approval – Download the PDF here

High Ridge Aviation aims to become a $10 billion leasing and lending platform tailored for a new era of aviation financing.

Among the many nasty side effects of the Covid-19 pandemic, airline debt may be the least talked about.

Yet, it weighs heavily on balance sheets and could be cataclysmic.

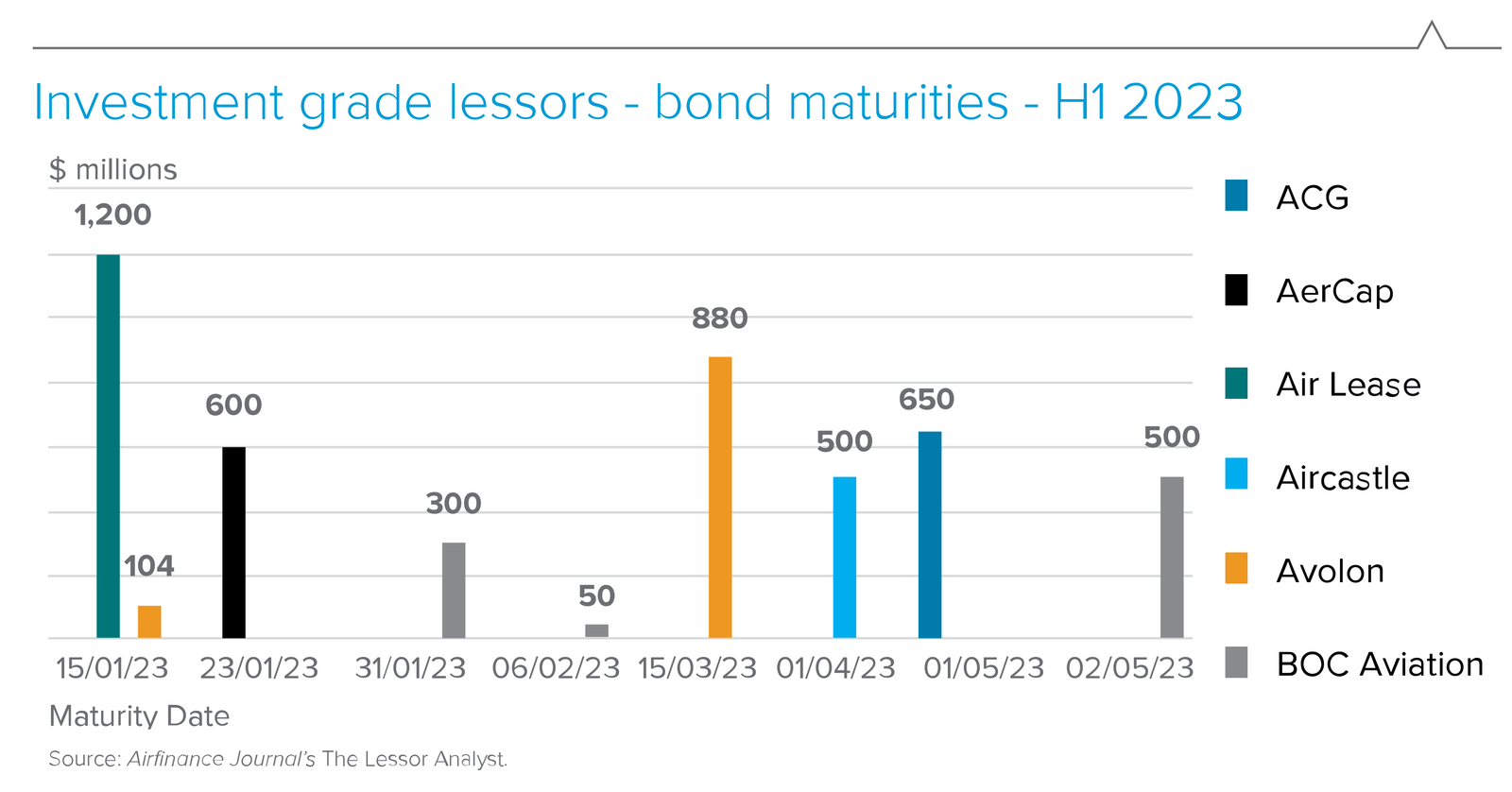

Total balance sheet debt, including operating leases per IFRS 16 and ASC 842, jumped to $665 billion as of mid-last year from $478 billion in the 2019/2020 timeframe, according to Airfinance Journal’s The Airline Analyst in its review of 186 airlines whose most recent last-12- month (LTM) financials range from 31 March 2021 to 30 June 2022.

Moreover, the debt-to-equity ratio was 5.0x, compared with the pre-Covid level of 2.0x.

Fixed charge cover, which best illustrates the affordability of the increased debt service, was only 0.3x compared with the pre-Covid figure of 2.3x.

Unfortunately, there is no magic wand to wave to return to pre-pandemic days and defuse debt burdens as the industry butts up against a climate crisis and a worsening economic outlook.

The head of the International Monetary Fund, Kristalina Georgieva, said on 1 January that “one-third of the world economy” will be hit by recession this year, and the world faces a “tougher” year in 2023 than the previous 12 months.

But, as the sector hurtles toward what could become the next financial shock to hit balance sheets, some relief might be found in an experienced management team backed by a $2 trillion investor and a Rolodex of aviation elite.

Start-up lessor High Ridge Aviation may be only weeks into business, but its ambitions to become a $10 billion business appear eminently feasible given its management pedigree and financial backing.

Safe at home

Greg Conlon, the industry veteran and former GECAS chief executive officer (CEO), launched High Ridge to rekindle the industrious spirit of 12 ex-GECAS and PK Airfinance colleagues with help from the financing bellows of US investment firm PIMCO.

The asset management platform also incorporates a lending arm, LR Airfinance, restoring the GECAS and PK Airfinance business duo of originating and managing loans for airlines, lessors and manufacturers.

While High Ridge is built with a nod to the past, its focus is set on a post-pandemic aviation sector needing to deleverage from the billions of dollars of debt amassed during the pandemic while engaging in a delicate balancing act of achieving net zero agendas and maintaining growth targets.

The sector’s challenges are not insuperable, but addressing them – while lessening debt levels – will take years.

It’s a very long path out, and we haven’t even started that yet,” says Conlon, who spent 20 years with GECAS and two years at its helm.

It’s a very long path out, and we haven’t even started that yet.”

– Greg Conlon, CEO, High Ridge Aviation

Airfinance Journal is aware of three lessors which are in discussion with manufacturers about their orderbooks. The portfolios all include Airbus A320neos, with one belonging to ALAFCO after selling 73 assets to Macquarie Airfinance. Would High Ridge assume any of those positions?

I think there are quite a few orderbooks out there if you want one. We have already looked at opportunities.”

– Greg Conlon, CEO, High Ridge Aviation

I think there are quite a few orderbooks out there if you want one. We have already looked at opportunities. The team has bought tens of billions of dollars of aircraft, so we know orderbooks very well. And we know how to underwrite that model and how to price it. We would certainly not shy away from an opportunity to look at orderbooks or portfolios of scale,” he says.

However, there are drawbacks. “Orderbooks are challenging in a yield market. You know the PDPs [predelivery payments] are a drag on a yield business when you’re just looking for an IRR [internal rate of return]. Also, you have to consider whether there is scarcity out there,” he says.

“It takes a fair amount of underwriting on an orderbook to know precisely what you’re buying. But we are just in our sixth week and haven’t seen the right one yet. We will continue to review opportunistic trades with OEM [original equipment manufacturer] partners. I think the opportunities will come in the next six, 12 to 18 months, so we’re excited about the prospects,” adds Conlon.

Narrowbody assets are the “most logical” purchase for High Ridge.

It is the largest part of the market, and it’s got return requirements that we understand, but we will look at widebodies.

Transition costs are a considerable challenge associated with widebody aircraft. “It can be punitive, so you need to understand that you are working with good investable assets and have your eyes wide open. But our team has done all kinds of stuff. We’ve done freighters, we’ve done midlife.”

High Ridge and Voyager Aviation Holdings (VAH), a privately owned aircraft investment firm with about $2 billion in assets, share backing from PIMCO.

VAH has been in the market recently with various aircraft portfolios. Are synergies or an outright sale likely because of the shared financial backing?

Eventually, we need to be close to $10 [billion] to have some scale on a long-term basis, and I’m talking between debt and leases. That feels like the right neighbourhood, but we don’t have to be there in 18 months. We have time.”

– Greg Conlon, CEO, High Ridge Aviation

It’s certainly something we would look at, just like any other opportunity. PIMCO is one of the world’s largest money managers, and they’re into a little bit of everything,” he says.

However, Conlon denies any interest in General Electric’s equity stake in Aercap as a lock-up period ends.

We are not in discussions over the Aercap shares,” he says. GE’s shares are subject to a lock-up period, which expires in stages from nine to 15 months following the sale of GECAS, which closed on 1 November 2021.

As part of the sale, GE received 111.5 million newly issued Aercap shares, about $23 billion of cash and $1 billion of Aercap senior notes.

Climate action

High Ridge has entered the market as the aviation sector is inexorably moving into another financial headwind as the convenient marriage of cheap finance and energy ends. Global airlines have committed to reaching net zero carbon emissions by 2050. Yet there is no decisive action plan, perhaps because there has yet to be a technological fix.

Furthermore, transparency is lacking, with only 15% of the world’s airlines reporting carbon emissions, according to aviation climate group, Impact. To achieve net zero, the International Air Transport Association estimates that $2 trillion is needed to support an industry-wide resolution. Not only will the sector have to invest billions of dollars in sustainable aviation fuel (SAF), air traffic control and infrastructure, but also manufacturers will have to develop newer, more efficient aircraft and engines.

But airlines first need to recover from the debt swell caused by Covid-19 and a costlier operating cost environment.

This tightrope act of building a more sustainable aviation market while emerging from the worst crisis in history is not lost on Conlon.

There is no doubt that there is a lot of pressure to improve balance sheets,” he says. “But, at the same time, you must grow and take more aircraft to heal. The market environment for the next three, four, or even five years will be very interesting. Interest rates will remain elevated.”

The consequences of failing to deliver innovative financing solutions to an industry still reeling from the shocks of the pandemic but also tasked with climate action could be profound. Increasingly, insurers and banks are sharpening their scrutiny of carbon- intensive portfolios with frameworks and structures to support the transition to net zero and re-price such risk. In other words, businesses must manage climate change or expect higher costs. JP Morgan added the aviation sector to a list of carbon-intensive businesses that it seeks to help decarbonise by 2050, according to a 2022 climate report issued on 20 December.

The Wall Street bank plans to reduce the carbon intensity of its aviation financing portfolio by 36% by 2030 from a 2021 baseline, it stated. However, Conlon stops short of supporting the idea that financiers or lessors should take on a different role in the path toward decarbonisation, such as being directly involved in SAF production.

It is an interesting question, and we have had a lot of discussions about who is best to bring that to market. I think there is a strong argument for the petroleum industry, which has gazillions of dollars to invest in refinery techniques, and others will logically take the lead on that.

It would be challenging for a leasing company to try to take the lead on developing SAF. I could be wrong. At High Ridge, our aspirations are matching the right capital with the return space,” adds Conlon.

When will that happen?

We are pleased with our response and are involved in various discussions,” he says. “I hope we have something for the Airfinance Journal Dublin event in January.”